The world of software development is a relentless engine of innovation, constantly pushing the boundaries of what’s possible. From artificial intelligence and machine learning to sophisticated enterprise solutions and groundbreaking consumer applications, software engineers are at the forefront, turning abstract ideas into tangible products that shape our daily lives and drive economic growth. This creative endeavor, however, is not without its costs, particularly in the realm of research and development (R&D). For decades, the U.S. tax code recognized the importance of these R&D investments by allowing immediate deductions for associated expenses, providing a crucial incentive for companies to innovate.

However, a significant shift enacted by the Tax Cuts and Jobs Act (TCJA) of 2017, which became effective for tax years beginning after December 31, 2021, has dramatically altered this landscape. Specifically, Section 174 of the Internal Revenue Code, which governs the treatment of "research and experimental expenditures," now mandates the capitalization and amortization of these costs over several years, rather than allowing for immediate deduction. This change has sent ripples through the tech industry, particularly impacting software companies and the engineers whose work constitutes a significant portion of these R&D efforts. This article delves into the intricacies of the revised Section 174, its specific implications for software engineers and the companies that employ them, and the strategies necessary to navigate this complex new tax frontier.

The Evolution of Section 174: From Immediate Deduction to Amortization Mandate

Prior to the TCJA, Section 174 was a cornerstone of U.S. tax policy aimed at fostering innovation. It allowed businesses to immediately deduct all "research and experimental expenditures" incurred during the taxable year. This "expensing" provision was a powerful incentive, as it reduced taxable income in the year the R&D costs were incurred, effectively lowering a company’s tax burden and freeing up capital for further investment in innovation. For the burgeoning software industry, where R&D is often the primary operational cost, this was incredibly beneficial. It encouraged startups to invest heavily in developing new products and features without the immediate financial penalty of deferred tax benefits.

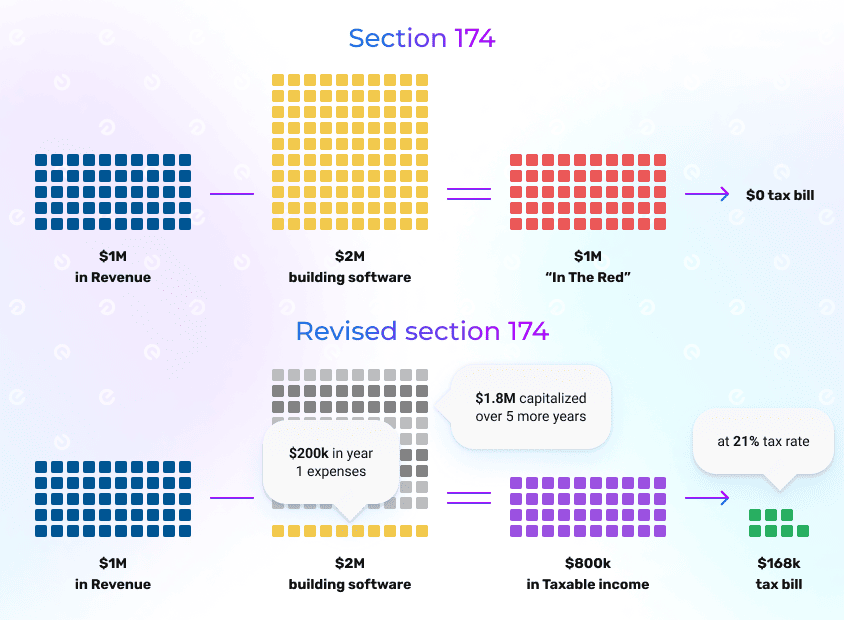

The TCJA, while celebrated for its corporate tax rate reduction, also included several provisions designed to broaden the tax base to offset some of the revenue loss. One such provision was the modification of Section 174. For tax years beginning after December 31, 2021, the option to immediately expense R&D costs was eliminated. Instead, companies are now required to:

- Capitalize these expenditures: This means treating them as an asset on the balance sheet rather than an immediate expense.

- Amortize them: Deducting a portion of these capitalized costs over a specified period. The amortization period is five years for research conducted in the United States and fifteen years for research conducted outside the United States.

This seemingly minor accounting change has profound cash flow implications, as companies can no longer immediately offset their R&D investments against their current year’s income. Instead, they must wait years to fully realize the tax benefits, even as the expenses are incurred in the present.

Defining "Research and Experimental Expenditures" for Software

A critical aspect of complying with the revised Section 174 is accurately identifying what constitutes "research and experimental expenditures" in the context of software development. While the IRS has provided some guidance, the lines can sometimes be blurry, requiring careful documentation and analysis. Generally, these expenditures include costs incident to the development or improvement of a product or process, encompassing both direct and indirect costs.

For software engineers and their projects, this typically includes:

- Salaries and Wages: A significant portion of R&D costs in software are the compensation paid to engineers, developers, testers, and project managers directly involved in qualifying R&D activities.

- Contract Research: Payments made to third-party contractors or consultants for R&D services.

- Supplies and Materials: Costs of computer hardware, software licenses, cloud computing services, and other materials directly consumed in R&D activities.

- Overhead Expenses: A portion of indirect costs such as utilities, rent, and administrative expenses directly attributable to R&D activities.

Crucially, the definition focuses on activities aimed at discovering information that is technological in nature and whose application is intended to develop new or improved functionality, performance, reliability, or quality. This includes:

- Developing new algorithms or software architectures.

- Creating novel operating systems or programming languages.

- Designing and developing new features that involve significant technical uncertainty.

- Improving existing software in a way that overcomes technical challenges or enhances its core functionality.

However, not all software development activities qualify. Routine maintenance, minor bug fixes, adapting existing products to customer needs without significant technical innovation, market research, quality control, and standard business administration are generally not considered Section 174 expenditures. The distinction often hinges on whether the activity involves technical uncertainty and the pursuit of new knowledge or solutions.

The Profound Impact on Software Engineers and Tech Companies

The revised Section 174 introduces a myriad of challenges and consequences for the software industry:

-

Increased Tax Burden and Reduced Cash Flow: The most immediate and significant impact is the increase in current taxable income for companies engaged in R&D. A company that previously deducted $1 million in R&D expenses might now only deduct $200,000 (1/5th) in the first year. This means a larger portion of their profit is subject to tax, even if that profit is reinvested in R&D. This can lead to a severe cash flow crunch, particularly for startups and small to medium-sized businesses (SMBs) that operate on tight margins and rely heavily on internal funding or early-stage investment. Some companies might even find themselves profitable on paper but facing a tax bill they cannot easily cover, potentially leading to difficult financial decisions.

-

Chilling Effect on Innovation: By delaying the tax benefits of R&D, Section 174 could disincentivize companies from investing in high-risk, long-term research projects. Why embark on a costly, uncertain R&D venture if the tax benefits are spread over five or fifteen years, rather than immediately reducing the cost? This could stifle the very innovation that drives the tech sector and keeps the U.S. competitive on a global scale, particularly in emerging fields like AI, quantum computing, and biotechnology.

-

Impact on Startups and Early-Stage Companies: Startups often operate at a loss in their initial years, pouring capital into R&D to build their core product. While they might not have taxable income to offset in early years, the ability to carry forward R&D deductions (Net Operating Losses, or NOLs) was a valuable future asset. Now, they must capitalize these losses, which further complicates their financial projections and could make them less attractive to investors who scrutinize cash flow and profitability.

-

Accounting Complexity and Compliance Costs: Companies must now meticulously track and categorize all R&D-related expenses to ensure proper capitalization and amortization. This requires robust accounting systems, potentially new software solutions, and increased time and resources for financial teams. The lack of detailed IRS guidance for software R&D further exacerbates this complexity, creating uncertainty and the potential for costly audits.

-

Competitive Disadvantage: Other nations, recognizing the strategic importance of R&D, often offer generous tax incentives for innovation. By reducing the immediate benefit of R&D expenditures, the U.S. risks placing its tech companies at a disadvantage, potentially encouraging them to shift R&D activities (and the associated engineering jobs) overseas to jurisdictions with more favorable tax treatments.

-

Direct Impact on Software Engineers: While the change directly affects companies, it indirectly impacts engineers. If companies scale back R&D investments due to financial pressure, it could lead to fewer job opportunities, slower hiring growth, or a shift in focus from pure research to more immediate, revenue-generating projects. Engineers working on cutting-edge, experimental technologies might find their roles re-evaluated.

Strategies for Navigating the New Section 174 Landscape

Despite the challenges, companies and software engineers can adopt several strategies to mitigate the adverse effects of the revised Section 174:

-

Proactive Financial Planning and Modeling: Companies must update their financial models to account for the capitalized R&D expenses and their amortization schedules. This includes projecting future tax liabilities and understanding the impact on cash flow. Early assessment allows for better budgeting and strategic decision-making.

-

Robust Documentation and Cost Segregation: Meticulous record-keeping is more critical than ever. Companies need systems to clearly identify and segregate Section 174 expenses from other operational costs. This involves tracking engineer time, project expenses, and the technical objectives of each development activity. Clear documentation will be essential for justifying capitalized costs to the IRS.

-

Leveraging the R&D Tax Credit (Section 41): It’s crucial to distinguish Section 174 (expense treatment) from Section 41 (the R&D Tax Credit). While Section 174 changed, the R&D Tax Credit is still available and can provide a dollar-for-dollar reduction in tax liability for qualified R&D expenses. This credit can partially offset the increased tax burden resulting from the capitalization of Section 174 costs. Companies should aggressively pursue this credit, ensuring they meet the four-part test for qualified research activities.

-

Consultation with Tax Professionals: Navigating the nuances of Section 174 requires specialized expertise. Engaging with tax advisors who have deep knowledge of R&D tax provisions and the software industry is paramount. They can help identify qualifying expenses, ensure compliance, and optimize tax strategies.

-

Exploring Alternative Funding and Investment: For startups and SMBs, securing additional funding or adjusting investment strategies might be necessary to absorb the immediate cash flow impact. This could involve seeking more venture capital, exploring debt financing, or re-evaluating burn rates.

-

Advocacy for Legislative Reform: The tech industry and various business groups are actively lobbying Congress for a reversal or modification of the Section 174 changes. Companies and individuals should consider supporting these advocacy efforts, as legislative action remains the most effective long-term solution to restore the immediate expensing of R&D costs.

The Broader Economic and Innovation Outlook

The shift in Section 174 is more than just a tax accounting detail; it’s a policy change with significant implications for the U.S. economy’s innovative capacity. Software engineers are the architects of the digital future, and their work directly contributes to advancements in healthcare, communication, transportation, and countless other sectors. Any policy that discourages investment in their critical R&D efforts poses a risk to national competitiveness and future economic growth.

While the immediate challenges are undeniable, the tech industry has a history of resilience and adaptation. Companies are learning to adjust their financial strategies, streamline their accounting processes, and advocate for more favorable tax treatment. However, without a legislative fix, the long-term impact on the pace of innovation and the global standing of U.S. tech companies remains a significant concern.

In conclusion, Section 174 has ushered in a new era for how research and experimental expenditures, particularly those in software development, are treated for tax purposes. Software engineers and their employers must understand these changes, adapt their financial planning, and explore all available mitigation strategies. The ability of the U.S. to maintain its leadership in technological innovation hinges not only on the brilliance of its engineers but also on a supportive tax environment that incentivizes, rather than penalizes, the pursuit of groundbreaking R&D.