In the dynamic and ever-evolving world of software engineering, discussions often revolve around groundbreaking technologies, innovative product features, and the latest programming paradigms. However, beneath the surface of code and algorithms, a seemingly obscure tax code provision has been quietly, yet profoundly, reshaping the financial landscape for tech companies, startups, and, by extension, the very engineers who drive innovation: Section 174 of the U.S. Tax Code.

Since its amendment under the Tax Cuts and Jobs Act (TCJA) of 2017 and its effective date of January 1, 2022, Section 174 has transformed the treatment of Research and Experimental (R&E) expenditures from an immediate deduction to a mandatory capitalization and amortization requirement. While this change impacts a broad spectrum of industries, its implications for the software sector are particularly acute, threatening to stifle innovation, strain cash flow, and ultimately, affect the career trajectories and opportunities for countless software engineers.

This article delves into the intricacies of Section 174, exploring its historical context, the critical changes it introduced, and its far-reaching consequences for software engineers and the tech industry. We will uncover why this seemingly technical tax detail has become a major concern, the strategies companies are adopting, and what the future might hold for an industry built on rapid development and constant iteration.

Understanding Section 174: From Immediate Deduction to Amortization

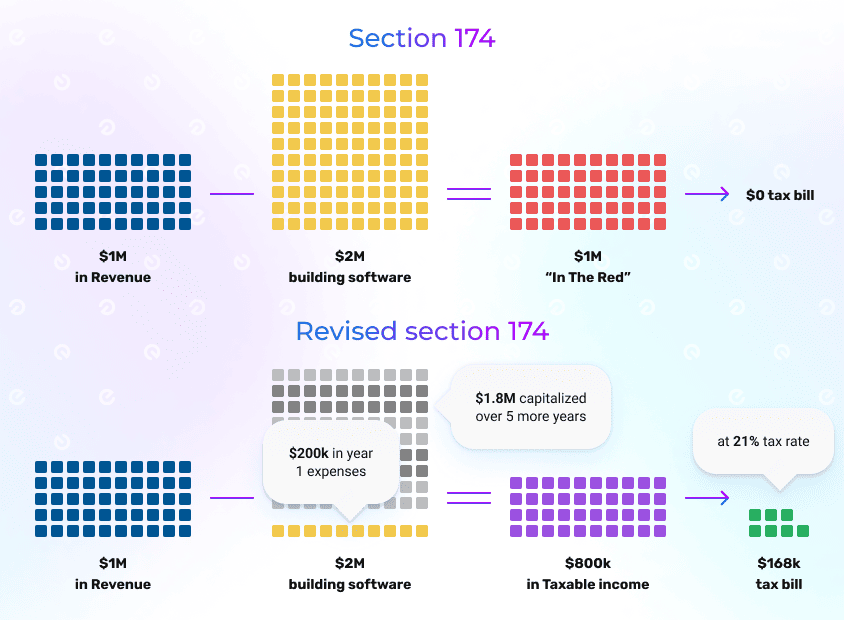

Before the TCJA amendments, Section 174 allowed companies to immediately deduct R&E expenses in the year they were incurred. This provision was a cornerstone of U.S. tax policy, designed to incentivize innovation by reducing the financial burden of research and development. For software companies, this meant that the significant costs associated with developing new software, improving existing applications, or even experimenting with new technologies—such as salaries for engineers, cloud computing resources, and testing equipment—could be fully written off against taxable income in the same year. This immediate deduction provided a substantial cash flow benefit, especially for early-stage startups that often incur high R&D costs before generating significant revenue.

The TCJA, enacted in late 2017, brought sweeping changes to the U.S. tax system. Among its less-publicized but highly impactful provisions was the amendment to Section 174. Effective for tax years beginning after December 31, 2021, companies are now required to capitalize their R&E expenditures. This means these costs can no longer be fully deducted in the year they are incurred. Instead, they must be treated as an asset and amortized (deducted incrementally) over a period of:

- Five years for R&E conducted within the United States.

- Fifteen years for R&E conducted outside the United States.

Crucially, the definition of "Specified Research or Experimental (SRE) expenditures" under Section 174 is broad and explicitly includes "software development." This means the vast majority of activities performed by software engineers—from designing new architectures and writing code to debugging and testing—now fall under this capitalization mandate.

Why Software is Hit Hard: The Nature of Innovation

The software industry is uniquely vulnerable to the changes in Section 174 due to its inherent characteristics:

- R&D as Core Business: For many tech companies, especially startups and those developing proprietary products, software development is their primary R&D. Unlike manufacturing where R&D might be a precursor to production, in software, the act of creation is often the R&D itself. A significant portion, if not all, of a software company’s operating expenses are directly tied to the development of new or improved software.

- Intensive Labor Costs: Software development is labor-intensive. Salaries, benefits, and related payroll taxes for highly skilled engineers constitute a major part of R&E expenditures. Capitalizing these costs means that companies are effectively paying taxes on money they’ve already spent on their workforce, before they’ve seen a full return on that investment.

- Rapid Iteration and Short Lifecycles: Software development is characterized by rapid iteration, agile methodologies, and often, relatively short product lifecycles. An immediate deduction aligned well with this reality, allowing companies to quickly account for costs associated with projects that might evolve rapidly or even be sunsetted. Amortizing these costs over five or fifteen years feels disconnected from the speed at which software evolves.

- Internal-Use Software: Many companies develop software for internal use (e.g., custom CRM systems, internal tools, operational platforms). While not directly sold, these developments are critical for efficiency and competitive advantage. The costs associated with developing such internal-use software also fall under the Section 174 capitalization rules.

The Impact on Software Engineers and the Tech Ecosystem

The ripple effects of Section 174 extend far beyond the accounting departments, directly influencing the careers and opportunities of software engineers:

- Increased Tax Burden and Reduced Profitability: Companies, particularly those in their growth phase, now face significantly higher taxable income because they can no longer fully deduct their R&D expenses. This leads to increased tax payments, directly reducing their net profits and available capital. For a startup, this can be the difference between breaking even and operating at a loss.

- Cash Flow Strain: The most immediate and critical impact is on cash flow. Companies must pay taxes on income that doesn’t fully reflect their true operational costs. This cash crunch can be devastating for startups and small to medium-sized businesses (SMBs) that rely on every dollar to fund operations, marketing, and future development.

- Reduced R&D Investment and Innovation: Faced with higher tax liabilities and tighter cash flows, companies are forced to re-evaluate their R&D budgets. This can lead to:

- Scaled-back Projects: Fewer ambitious, long-shot projects that could lead to breakthrough innovations.

- Slower Product Development: Companies might delay new features or product launches to conserve cash.

- Less Experimentation: A reduced appetite for risk-taking and exploring unproven technologies.

For software engineers, this means potentially working on fewer cutting-edge projects, a slower pace of innovation, and less opportunity to explore new technical frontiers.

- Hiring Freezes and Layoffs: With reduced capital and profitability, companies may cut back on hiring or, in extreme cases, resort to layoffs. This directly impacts job security and career growth opportunities for software engineers across the industry. Startups, which are often significant job creators in the tech sector, become less viable, leading to fewer new engineering roles.

- Competitive Disadvantage: The U.S. is now an outlier among developed nations that largely offer immediate deductions or enhanced credits for R&D. This puts U.S.-based tech companies at a competitive disadvantage globally, potentially incentivizing companies to shift R&D activities—and thus, engineering jobs—to countries with more favorable tax treatments.

- Focus on Short-Term Gains: The pressure to generate immediate revenue to offset capitalized R&D costs can shift company focus away from long-term strategic investments towards short-term, revenue-generating projects. This can stifle foundational research and development that underpins future growth. For engineers, this might mean less emphasis on robust architecture, technical debt repayment, or innovative infrastructure, in favor of quick-feature development.

- Administrative Burden: Companies must now meticulously track and classify R&E expenditures for tax purposes, adding an administrative burden and requiring specialized accounting expertise, further diverting resources.

Navigating the New Landscape: Strategies and Advocacy

In response to Section 174, tech companies are exploring various strategies:

- Aggressive Tax Planning: Working closely with tax advisors to understand the nuances of the law, identify non-SRE expenses that can still be immediately deducted, and optimize their capitalization schedules.

- Cost Segregation Studies: Carefully analyzing all development costs to differentiate between those that clearly fall under Section 174 (e.g., direct coding) and those that might be considered operational or administrative and thus still deductible.

- Budget Reallocation: Prioritizing R&D projects more stringently and potentially reallocating funds from other areas to cover increased tax liabilities.

- Advocacy and Lobbying: The tech industry, alongside other R&D-intensive sectors, has been actively lobbying Congress to revert or amend Section 174. Organizations like the National Association of Manufacturers (NAM) and various tech industry groups are pushing for legislative fixes.

The Road Ahead: Legislative Efforts and Hope

There is significant bipartisan recognition of the adverse impact of Section 174. Lawmakers from both sides of the aisle have voiced concerns about its effect on American innovation and competitiveness. Various legislative proposals have been introduced to either fully repeal the capitalization requirement or delay its implementation.

The "Tax Relief for American Families and Workers Act of 2024," though ultimately not passed, was a prominent example of these efforts. It sought to restore the immediate deduction for R&D expenses, among other tax benefits. While this specific bill stalled, the persistent advocacy from industry leaders, trade associations, and even individual businesses indicates that legislative action remains a high priority. Many remain hopeful that a future bill will address this critical issue, potentially restoring the immediate deduction for R&D or providing a more favorable amortization schedule.

For software engineers, understanding these legislative efforts is crucial. A successful repeal or amendment of Section 174 could unlock significant capital for tech companies, leading to renewed investment in R&D, increased hiring, and a more vibrant ecosystem for innovation. Conversely, continued inaction could exacerbate the challenges, pushing the industry towards a more conservative and less experimental future.

Conclusion

Section 174 represents more than just a change in tax law; it signifies a fundamental shift in how the U.S. government views and treats the very engine of modern progress: research and development. For software engineers, whose daily work constitutes the core of this R&D, the implications are profound. From influencing job markets and project scope to impacting the overall pace of technological advancement, this tax provision casts a long shadow over the industry.

As the tech sector continues to grapple with these changes, awareness and informed advocacy become paramount. Software engineers, whether as employees, founders, or simply stakeholders in the innovation economy, have a vested interest in understanding Section 174 and supporting efforts to ensure that U.S. tax policy continues to foster, rather than hinder, the groundbreaking work that defines their profession. The future of American innovation may well depend on it.