In today’s hyper-regulated global economy, businesses of all sizes find themselves perpetually navigating a complex and ever-shifting landscape of laws, standards, and guidelines. From data privacy (GDPR, CCPA) to financial reporting (SOX, Basel III), industry-specific regulations (HIPAA, FDA), and environmental mandates, the sheer volume and intricacy of compliance obligations can be overwhelming. Failure to comply can result in severe penalties, hefty fines, reputational damage, and even operational shutdowns. It is within this challenging environment that Regulatory Compliance Management Software (RCMS) emerges not just as a helpful tool, but as an indispensable strategic asset for modern organizations.

What is Regulatory Compliance Management Software (RCMS)?

Regulatory Compliance Management Software (RCMS) is a specialized category of enterprise software designed to help organizations systematically identify, track, manage, and report on their compliance with various internal policies and external regulations. At its core, RCMS aims to centralize and automate many of the manual, disparate processes traditionally associated with compliance, transforming a reactive, ad-hoc approach into a proactive, integrated, and continuous one.

Unlike generic project management tools or simple spreadsheets, RCMS is built with the specific nuances of regulatory compliance in mind. It provides a structured framework to manage the entire compliance lifecycle, from understanding regulatory requirements and assessing risks to implementing controls, monitoring adherence, and demonstrating compliance to auditors and regulators.

The Evolving Landscape: Why RCMS is More Critical Than Ever

The need for robust RCMS has intensified due to several interconnected trends:

- Explosion of Regulations: The number and scope of regulations have grown exponentially across all sectors and geographies. What might have been a handful of key rules a decade ago has now morphed into hundreds, if not thousands, of specific requirements.

- Increased Complexity and Interconnectedness: Regulations are no longer isolated; they often overlap, conflict, or have ripple effects across different departments and international borders. Managing these interdependencies manually is nearly impossible.

- Higher Stakes and Penalties: Regulators are imposing steeper fines and more severe legal consequences for non-compliance. Beyond financial penalties, personal liability for executives and significant reputational damage are increasingly common.

- Demand for Transparency and Accountability: Stakeholders, including customers, investors, and the public, demand greater transparency from organizations regarding their ethical conduct and adherence to standards.

- Rapid Technological Change: New technologies (AI, IoT, cloud computing) introduce new compliance challenges related to data security, privacy, and ethical use, requiring organizations to adapt quickly.

- Remote Work and Distributed Operations: The shift to remote and hybrid work models has complicated compliance oversight, making centralized software solutions even more vital for consistent application of policies and controls.

In this volatile environment, relying on manual processes – spreadsheets, email chains, and shared drives – is not only inefficient but also inherently risky, prone to human error, oversight, and a lack of real-time visibility.

Key Features of Regulatory Compliance Management Software

A robust RCMS solution typically offers a comprehensive suite of features designed to streamline and strengthen compliance efforts:

- Centralized Regulatory Repository: A single, authoritative source for all relevant laws, regulations, internal policies, and industry standards. This ensures everyone is working from the most current and accurate information.

- Risk Assessment and Management: Tools to identify, assess, categorize, and prioritize compliance risks. This often includes heat maps, scoring mechanisms, and the ability to link risks directly to specific regulations and controls.

- Policy and Procedure Management: Features to create, publish, distribute, track acknowledgments, and manage versions of internal policies and procedures. This ensures employees are aware of and attest to understanding company guidelines.

- Control Management: The ability to define, implement, and track controls designed to mitigate identified risks and meet regulatory requirements. This includes assigning ownership, scheduling reviews, and documenting evidence of control effectiveness.

- Audit Management and Evidence Collection: Streamlines the audit process by providing a clear framework for gathering, storing, and presenting evidence of compliance. It helps manage audit trails, track auditor requests, and facilitate responses.

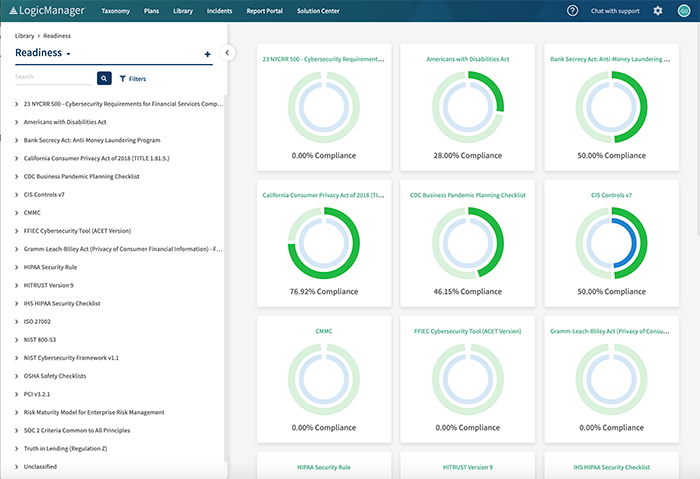

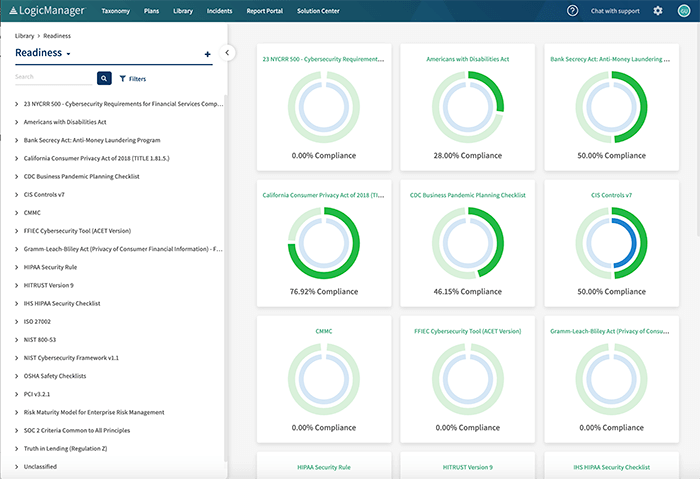

- Reporting and Analytics: Comprehensive dashboards and reporting capabilities that provide real-time insights into the organization’s compliance posture. This includes metrics on control effectiveness, risk exposure, policy adherence, and incident trends.

- Task and Workflow Automation: Automates routine compliance tasks, such as control testing, policy reviews, and incident reporting workflows, reducing manual effort and ensuring timely completion.

- Alerts and Notifications: Proactive alerts for upcoming deadlines, changes in regulations, control failures, or policy violations, ensuring that relevant stakeholders are informed immediately.

- Incident Management: A structured approach to record, investigate, and resolve compliance-related incidents, breaches, or violations, including root cause analysis and corrective action planning.

- Training and Awareness Management: Tools to assign, track, and report on mandatory compliance training for employees, ensuring they have the necessary knowledge to adhere to regulations and policies.

- Integration Capabilities: The ability to integrate with other enterprise systems such as GRC (Governance, Risk, and Compliance) platforms, HR systems, IT service management (ITSM), and enterprise resource planning (ERP) systems for a holistic view.

The Tangible Benefits of Implementing RCMS

Adopting an RCMS brings a multitude of strategic and operational advantages:

- Mitigate Risk and Avoid Penalties: By providing a structured, proactive approach to compliance, RCMS significantly reduces the likelihood of non-compliance, thereby minimizing the risk of fines, legal action, and reputational damage.

- Improve Efficiency and Reduce Costs: Automating manual tasks, centralizing information, and streamlining workflows free up valuable time for compliance officers and other staff, allowing them to focus on more strategic initiatives. This also reduces the operational costs associated with manual compliance efforts.

- Enhanced Visibility and Control: RCMS offers a clear, real-time view of the organization’s compliance status across all departments and regulations. This enables better decision-making and allows management to identify and address issues before they escalate.

- Foster a Culture of Compliance: By making policies accessible, training trackable, and responsibilities clear, RCMS helps embed a culture where compliance is seen as a shared responsibility rather than just an obligation of a single department.

- Better Audit Preparedness: With all compliance data, evidence, and audit trails centralized and organized, organizations are always "audit-ready," significantly reducing the stress, time, and resources typically consumed by external audits.

- Protect Reputation and Build Trust: Demonstrating a commitment to compliance through robust systems enhances the organization’s reputation among customers, investors, partners, and regulators, building trust and confidence.

- Scalability and Adaptability: As businesses grow, expand into new markets, or face new regulations, RCMS provides a scalable framework that can adapt to evolving compliance needs without requiring a complete overhaul of processes.

- Strategic Alignment: By integrating compliance with broader risk management and governance frameworks, RCMS helps align compliance efforts with overall business objectives, transforming it from a cost center into a strategic enabler.

Who Needs Regulatory Compliance Management Software?

While large enterprises with complex global operations are obvious candidates, RCMS is becoming increasingly relevant for:

- Financial Services: Banks, investment firms, insurance companies dealing with extensive financial regulations (Dodd-Frank, MiFID II, Basel III).

- Healthcare: Hospitals, clinics, pharmaceutical companies navigating patient data privacy (HIPAA), drug approval (FDA), and other medical regulations.

- Technology Companies: SaaS providers, cloud service providers, and tech startups managing data privacy (GDPR, CCPA), cybersecurity, and intellectual property.

- Manufacturing: Companies facing environmental regulations, product safety standards, and supply chain compliance.

- Any organization with sensitive data: Given the pervasive nature of data privacy laws, virtually any company handling personal information can benefit.

- Growing businesses: As companies expand, manual compliance becomes untenable. RCMS provides the infrastructure for sustainable growth.

Implementing RCMS: Best Practices

Successful RCMS implementation requires careful planning and execution:

- Define Scope and Objectives: Clearly articulate what regulations the software will cover, which departments will be involved, and what specific outcomes are desired.

- Secure Stakeholder Buy-in: Gain commitment from leadership, IT, legal, and operational teams. Compliance is a cross-functional effort.

- Vendor Selection: Research and choose a vendor whose solution aligns with your specific industry, regulatory requirements, and organizational size. Consider scalability, integration capabilities, and customer support.

- Data Migration and Integration: Plan carefully for migrating existing compliance data and integrating the RCMS with other critical business systems.

- Training and User Adoption: Provide comprehensive training to all users to ensure effective adoption and maximize the software’s benefits.

- Phased Rollout: Consider a phased implementation, starting with a critical regulation or department, before expanding across the organization.

- Continuous Improvement: Regulatory compliance is ongoing. Regularly review and update your RCMS configuration, processes, and controls to adapt to changes.

The Future of Regulatory Compliance Management Software

The evolution of RCMS is likely to be shaped by advancements in artificial intelligence (AI), machine learning (ML), and blockchain technology:

- AI and ML for Predictive Compliance: AI can analyze vast amounts of regulatory data, identify emerging trends, and even predict potential compliance risks before they materialize. ML algorithms can automate the mapping of regulations to internal controls and flag anomalies in compliance data.

- Enhanced Automation: Further automation of control testing, evidence collection, and reporting will free up compliance professionals for more strategic, interpretive tasks.

- Blockchain for Immutable Audit Trails: Blockchain technology could provide tamper-proof, transparent records of compliance activities, making audit trails more secure and verifiable.

- Greater Personalization and Contextualization: RCMS will become more adept at tailoring compliance requirements and training to individual roles and responsibilities within an organization.

- Proactive vs. Reactive: The future will see RCMS moving even further from a reactive "check-the-box" approach to a proactive, integrated system that actively contributes to business strategy and resilience.

Conclusion

In an era defined by increasing regulatory scrutiny and escalating consequences for non-compliance, Regulatory Compliance Management Software is no longer a luxury but a fundamental necessity for organizations striving for resilience, integrity, and sustainable growth. By centralizing information, automating processes, and providing real-time visibility, RCMS empowers businesses to transform compliance from a burdensome obligation into a strategic advantage. It allows organizations to navigate the regulatory labyrinth with confidence, ensuring not just adherence to the law, but also the protection of their reputation, the trust of their stakeholders, and their long-term success in an ever-changing world.